eToro Review 2025: Learn Cryptocurrency from Experienced Investors

eToro

Product Name: eToro

Product Description: eToro offers commission free trades on stocks, ETfs, and options. I also offers a CopyTrader features that allows you to follow successful investors.

Summary

At eToro, you can invest in stocks, ETFs, and options without commissions. Its CopyTrader feature allows you to automatically copy the portfolios and trades of successful investors on the platform. You can get started for as little as $50.

Pros

- No commissions on stocks, ETFs, or options

- Start with $50

- CopyTrader features

- Paper trading available

Cons

- Limited crypto trading in the US

- Limited customer service options

eToro was one of the first platforms for trading cryptocurrencies and has millions of users from over 140 countries. With its powerfully simple and user-friendly interface, it’s grown to become more than just an app to trade cryptocurrencies – it’s built up a thriving community where users get to engage, connect, and learn from one another.

It’s free to create an account, and you can dip your toe in by playing with a $100,000 virtual portfolio before putting in your own money. You can also use their CopyTrader technology that lets you mimic, in real-time, what popular traders are doing.

Since it’s free, you can sign up and test-drive all aspects of the platform.

At a Glance

- Commission-free trades on stocks, ETFs, and options

- $50 minimum deposit

- Bitcoin and Etherum are available in the US

- CopyTrader features

- Paper trading

Who Should Use eToro

eToro is good for those who want to mirror the portfolios of successful traders. You should also consider eToro if you want to invest in crypto along side your stocks and ETFs. One of the challenges of adding crypto to your investment portfolio is having to trade on multiple platforms.

We like the straightforward pricing and no-commission stock trades, while the social trading capability of CopyTrader, and eToro’s Smart Portfolios are unique features that aren’t available on other platforms.

eToro Alternatives

| Minimum initial deposit | $100 | $1 | $20 |

| Available investments | Stocks, ETFs, and crypto | Stocks, ETFs, options, futures, and crypto | Stocks, ETFs, bonds, options |

| Abiliy to copy portfolios | Yes | No | No |

| Learn more | Learn more | Learn more |

Table of Contents

What is eToro?

Founded in 2007, eToro claims to be the #1 social trading platform. It has more than 15 million users worldwide, operating in 140 countries around the world.

The company operates internationally with four offices around the world. The US office is in Hoboken, New Jersey, and it has three international offices: Cyprus, London, and Sydney.

eToro operates as a diversified trading platform outside the US. You can trade stocks on foreign exchanges as well as currencies – including cryptocurrencies.

eToro Features and Benefits

| Feature | Description |

|---|---|

| Minimum initial investment | $50 |

| Available Investments | Stocks, ETFs, Options, and Crypto |

| Acceptable payment methods | Debit card, online banking, PayPal, or wire transfer |

| Availability | In addition to being available in 74 countries, eToro is available in all US states, the District of Columbia, Puerto Rico, US Virgin Islands, Northern Marianas, and the US Minor Outlying Islands. Crypto is not available in NY, NV, HI, PR, and USVI. |

| Access | Accessible via web browser and iPhone or Android mobile app. |

| Customer service | Available via AI chatbot or ticketing system No phone contact is offered. You can open a ticket with a response time of up to 48 hours. Members with a balance of at least $5,000 can contact customer service via WhatsApp. |

| FDIC Insurance | Cash held at eToro USA is fully FDIC insured. The funds in the account are held in an FDIC insured custodial account, which will be insured for up to $250,000 per depositor. This insurance coverage is available only to US residents. It covers your cash on deposit only, not your investments. |

Available Investments

Stocks and ETFs

eToro offers ETF and global stock trades with no commissions. In fact, eToro even pays the regulatory transaction fees for you. You can buy fractional shares, so you can get started with as little as $50. The minimum withdrawal is $30.

You can set up recurring transfers to ensure that you are regularly contributing to your investments.

eToro offers over 300 ETFs, including index ETFs, Dividend ETFs, Bond ETFs, and Commodity ETFs.

Options

You can trade options at eToro with no commissions or per contract charges in the US. Also, your cash earns 3.9% APY when not invested. You do need to qualify for options trading, not all customers will have access to options and it is available in the US only.

Regulatory fees still apply for options trades.

Crypto

As of 9/11/2024, eToro in the United States supports trading in just three cryptocurrencies: Bitcoin (BTC), Bitcoin Cash (BCH), and Ethereum (ETH).

There is a 1% fee for buying or selling crypto.

CopyTrader Technology

eToro puts a unique spin on trading with CopyTrader, a platform that lets you replicate trades made by top-performing traders. There are no additional fees for copying other traders, and the copy minimum is only $200.

The CopyTrader process is simple:

- View the public profiles of top-performing traders, and choose the one you wish to copy. You can filter your search by performance, assets, risk score, etc. You can copy up to 100 traders at a time.

- Decide on the amount you want to copy (minimum is $200).

- Select “Copy” to instantly replicate their trades.

You can select which percentage of your portfolio you’d like to dedicate to copying the trader of your choice. You can also select to only copy new trades to slowly integrate the new trades into your account.

You retain full control over your portfolio and can buy and sell as you see fit. You can also pause or stop copying at any time.

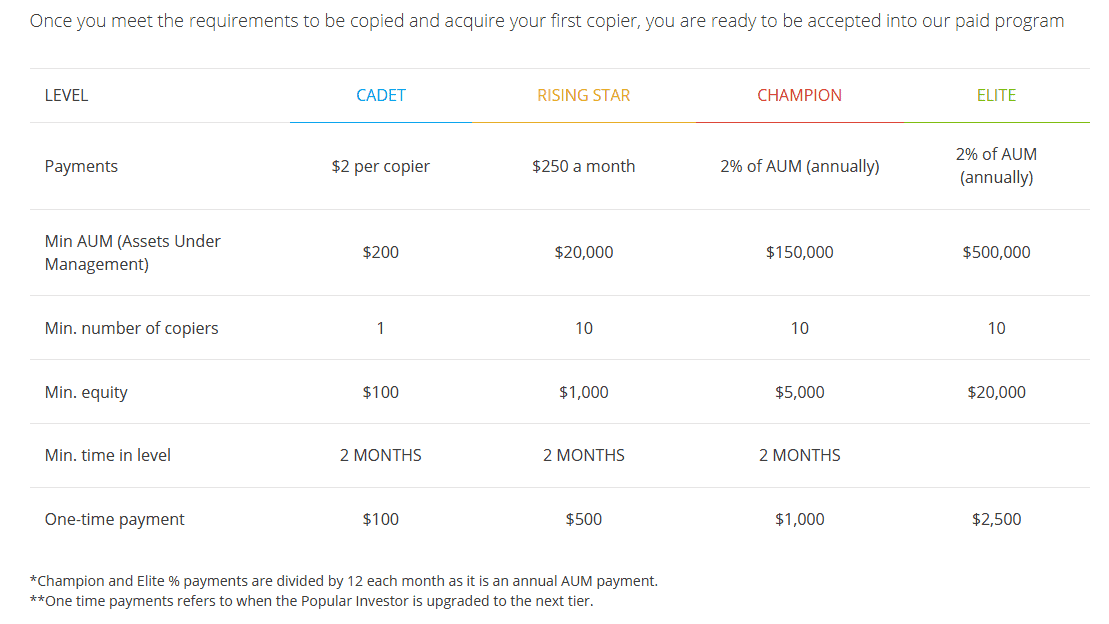

And just in case you’re feeling a little guilty over copying the work of top traders on the platform, know that those traders get paid directly under the Popular Investor Program.

Once you become familiar with trading cryptos on the platform, you can become part of the Popular Investor program and earn income while others copy your trades. It’s an opportunity to earn extra income every month as well as to be featured prominently as a leader in the eToro community.

You’ll earn a fixed payment for each copier, as well as bonuses for moving up in rank. And naturally, the more people copy your trades, the higher your income will be.

The income hierarchy for the Popular Investor Program is as follows:

Virtual Portfolio

Like many large investment brokerage firms, eToro enables you to “paper trade” before you go live and risk real money. You’ll have access to a virtual portfolio of $100,000 to practice your investment strategies and learn how the platform works without risking your own money.

eToro USA LLC; Investments are subject to market risk, including the possible loss of principal.

eToro Wallet

In the cryptocurrency universe, a digital wallet is necessary to securely store your crypto. You can transfer your crypto from the trading platform to your digital wallet, as well as both send and receive crypto to and from other wallets. You can also use the wallet to convert one crypto to another.

Though you can always use an external digital wallet, there are obvious benefits to taking advantage of the same service with the platform where you trade crypto. You’ll have a wallet immediately available for easy transfers from the trading platform and also avoid the fees of having a separate wallet with a third-party provider.

There are no fees to send or receive transactions to and from the wallet. However, blockchain fees apply to all transactions.

Unfortunately, it’s not possible to send crypto back to the trading platform from the wallet.

Smart Portfolios

eToro offers Smart Portfolios, which are collections of securities handpicked by the eToro Investment Team using a predetermined investment strategy. Investors benefit from professional research and a low minimum investment amount of $500.

Here is a sampling of the available Smart Portfolios, along with the industry sectors represented in each investment:

- Renewable Energy: Tech/Manufacturing/Utilities

- Auto Industry: Manufacturing/Durable Goods

- Cancer-Med: Medical Technology

- AsianDragons: Tech/Financial Services/Durable Goods

eToro USA LLC; Investments are subject to market risk, including the possible loss of principal.

eToro Alternatives

M1 Finance

If you like eToro’s CopyTrader features, you may also be interested in M1 Finance. M1 allows you to copy model portfolios, called pies. One big difference is that you can’t make adjustments to the model portfolio, although you can make it just part of your overall investments.

Note that M1 Finance also does not facilitate day trading, as all trades will occur in set windows each day. They don’t charge commissions, but there is a $3 per month fee for accounts under $10,000.

Here’s our full M1 Finance review for more information.

Robinhood

Robinhood also offers commission free trades and has more crypto options than eToro. It doesn’t offer any features like CopyTrading, but there is a community of traders to learn from.

Robinhood does support day trading and offers after-hours trading. Your uninvested cash earns a high interest rate and you can get started for just $1.

Here’s our full Robinhood review for more information.

Public

Public is another trading platform with commission-free trades. In fact, you can actually get a rebate on your options trades, meaning you could get paid to trade options. You can trade crypto, but not directly through the Public app. Public partnered with Bakkt Crypto to provide this service.

Public also offers a 1% match on IRA contributions. So if you are investing for retirement, Public is worth considering.

Here’s our full Public review for more information.

Should You Invest with eToro?

One of the challenges of adding crypto to your investment portfolio is having to trade on multiple platforms. eToro solves this problem by allowing you to buy and sell crypto alongside stocks and ETFs. We like the straightforward pricing and no-commission stock trades, while the social trading capability of CopyTrader, and eToro’s Smart Portfolios are unique features that aren’t available on other platforms.

eToro USA LLC; Investments are subject to market risk, including the possible loss of principal.

Other Posts You May Enjoy:

Webull Review: A Free Investing App for Experienced Investors

Webull Product Name: Webull Product Description: Webull is a trading platform that has $0 commissions on stocks, ETFs and options. …

Is the 4% rule outdated? Its creator weighs in

William Bengen proposed the 4% safe withdrawal rate in 1994. Thirty years on from that suggestion, we look at whether it still makes sense – including Bengen’s current thinking.

How to Find an Old or Missing 401(k)

It can be easy to misplace important documents, like 401(k) details from a previous employer. Yet, these funds are vital to retirement planning and calculating your net worth. Or, perhaps you’re the surviving spouse or child trying to track down an estate benefit. Here are the steps you can follow to find an old 401(k).

Wealthfront Review 2025: Low-cost Roboadvisor with Loss Harvesting, Rebalancing

Launched in 2011, Wealthfront is a robo-advisor with $75+ billion in assets under management as of January 2025. A robo-advisor…

About Kevin Mercadante

Since 2009, Kevin Mercadante has been sharing his journey from a washed-up mortgage loan officer emerging from the Financial Meltdown as a contract/self-employed “slash worker” – accountant/blogger/freelance blog writer – on OutofYourRut.com. He offers career strategies, from dealing with under-employment to transitioning into self-employment, and provides “Alt-retirement strategies” for the vast majority who won’t retire to the beach as millionaires.

He also frequently discusses the big-picture trends that are putting the squeeze on the bottom 90%, offering workarounds and expense cutting tips to help readers carve out more money to save in their budgets – a.k.a., breaking the “savings barrier” and transitioning from debtor to saver.

Kevin has a B.S. in Accounting and Finance from Montclair State University.

Opinions expressed here are the author’s alone, not those of any bank or financial institution. This content has not been reviewed, approved or otherwise endorsed by any of these entities.